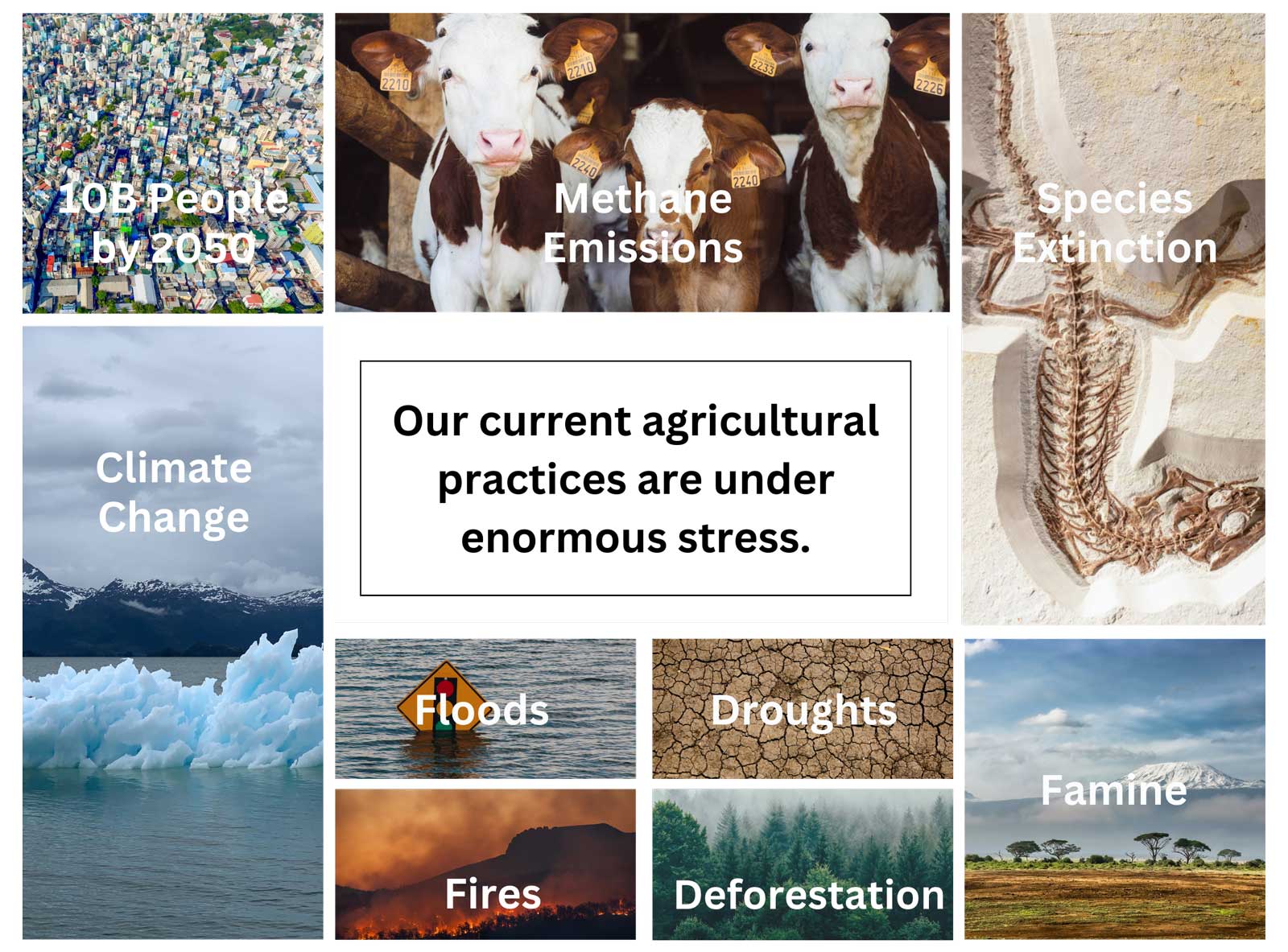

We focus on accelerating the advancement of sustainability innovations to provide long term climate change solutions whilst offering risk-adjusted returns.

Our Name

Short for “Natural Capital”, our name refers to the earth’s natural assets which provide the opportunity to build a resilient, sustainable agricultural sector which creates long term value. These natural assets include:

Soil

Water

Flora

Fauna

Our Vision

“To help build a resilient, sustainable agricultural sector that has strong financial returns and a direct impact on climate change.”

Our Mission

Mobilise Capital at scale for maximum impact

Invest in the best risk adjusted Ag Tech opportunities globally

Make Ag Tech part of the climate change solution

Our Team

With extensive experience across agriculture, finance and investment banking, NatCap Ventures has the experience and resources necessary to identify and qualify Ag Tech opportunities across a broad range of areas, enabling them to scale and creating impact through the mobilisation of capital.

Directors

John Graham

Founder and MD – NatCap Ventures and NatCap Funds Management

With over 25 years’ experience in Investment Banking, Venture Capital and Private Equity, John’s focus is on identifying the best global investment opportunities in AgTech.

Non-Executive Director NatCap Ventures

With extensive experience in Agriculture and a successful exit of Harrington Systems Electrics, Will is currently the founder of Wi-Sky, which is rolling out broadband connectivity to over 100,000 square kilometres of land in regional and remote areas of Queensland.

Danny Bourke

Non-Executive Director NatCap Ventures

With over six decades of experience in Australian Agriculture, Danny has achieved many milestones including being the founder and CEO of IAMA which listed on the ASX in the early 80’s.

Our Value Add