The AgTech revolution has begun

NatCap Ventures wants to accelerate the development of technology and digitisation across agriculture by investing in the companies initiating these changes.

Our extensive experience in agriculture, finance and investment banking allows NatCap to quickly identify and qualify these opportunities.

An intense focus on sustainability across all aspects of agriculture will ensure the industry is well positioned as it transitions to a carbon neutral future.

Global Opportunities

As a specialist AgTech VC fund we source global investment opportunities from pre-seed to series B.

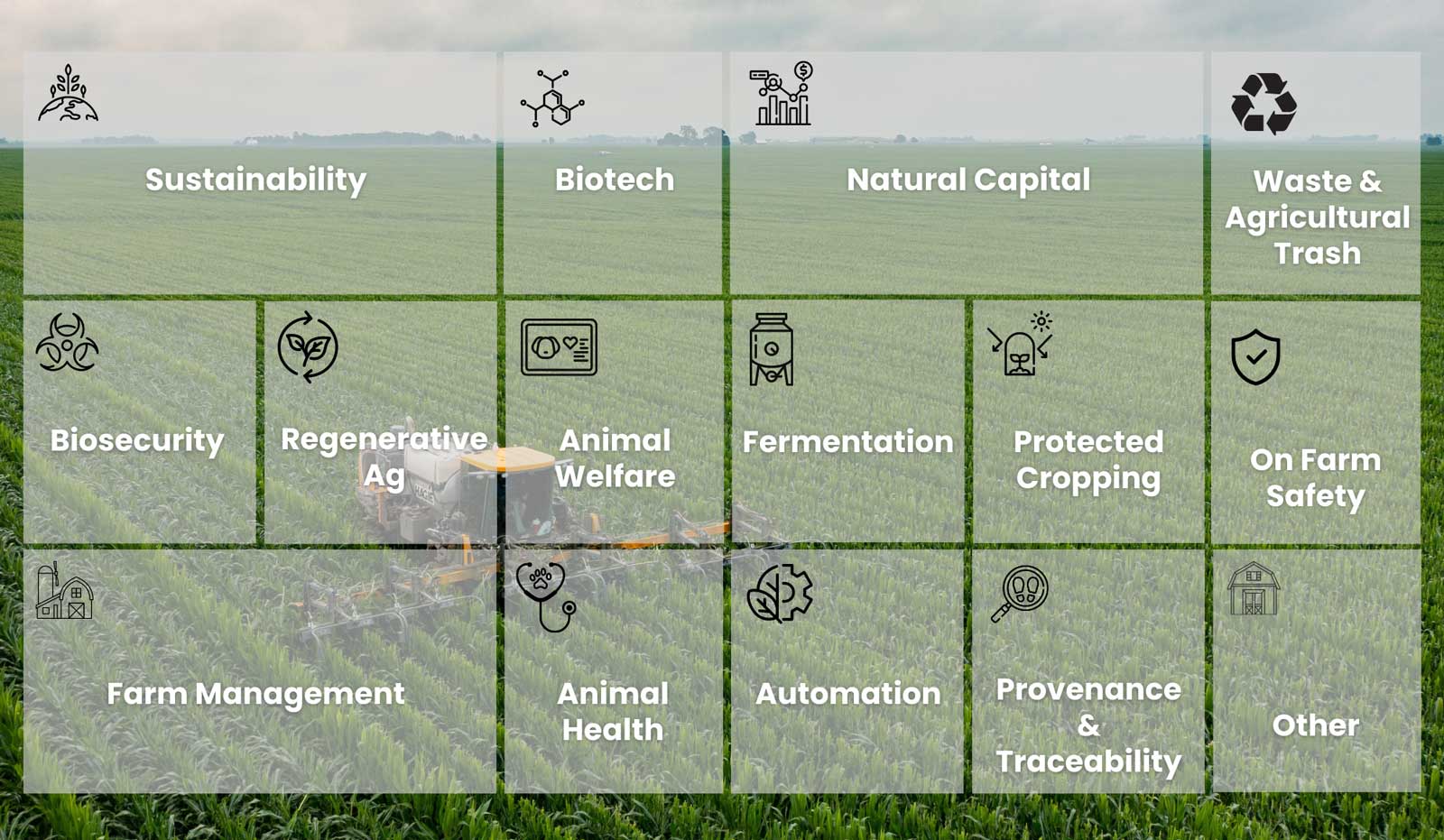

Investment Focus

Our Process

Network |

|

| Executive team works with global networks across agriculture, banking, finance and funds management in addition to ongoing activity with incubators and accelerators. |

Development |

|

| Continuous development of formal agreements with other global Ag Tech VC funds promotin co-investment opportunities and the mobilisation of capital at scale to create maximum impact. |

Analysis |

|

| Initial top-down macro analysis to identify and understand problems in the paddock, followed by a detailed bottom-up approach, looking at every aspect of the entity. |

Screening |

|

| Extensive screening occurs to ensure the fund meets its obligations associated with the investment thesis, fund mandate, ESG metrics and UN Sustainability goals. |

Compliance |

|

| Engage services from key external advisors such as lawyers, accountants, IP specialists and R&D experts to ensure the investment meets our strict criteria. |

Nurture |

|

| Nurture relationships with founders to understand key strengths required to ensure success and alignment with the “triple bottom line”. |